-

Overview

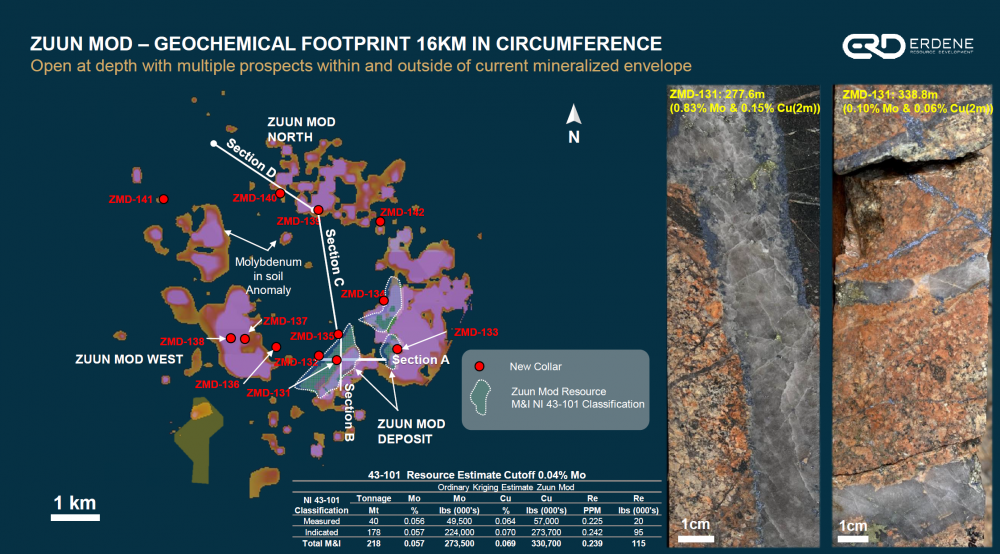

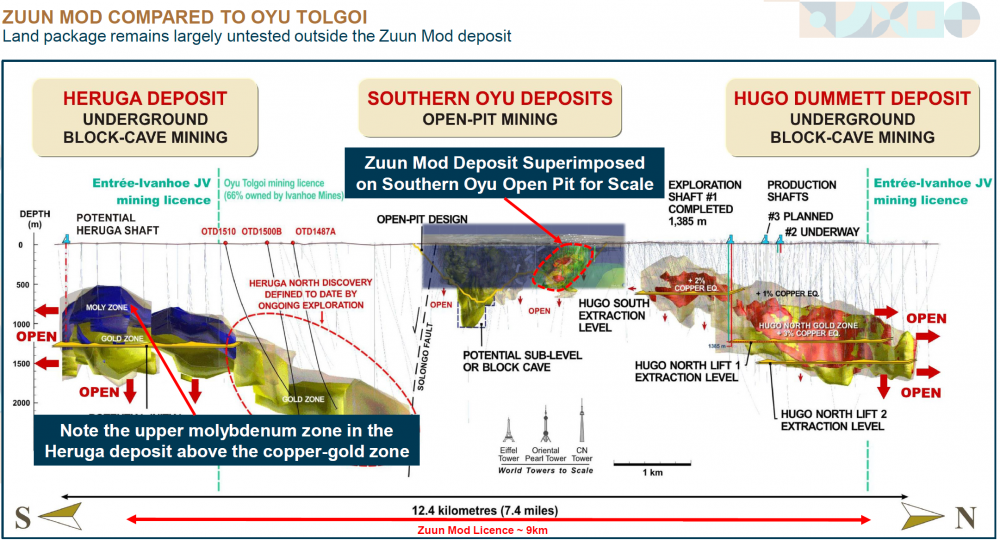

Located within 200 kilometers of China’s border in Mongolia’s Bayankhongor Province, and 35 kilometers east of the Company’s Bayan Khundii project, the 100% Erdene-owned Zuun Mod porphyry complex measures 16 kilometers in circumference and hosts broad zones of molybdenum mineralization. The deposit is located within a Mining License, which is valid for an initial 30-year term with provision to renew the license for two additional 20-year terms.

In a three-kilometer extended portion of the system, referred to as the South Corridor, Erdene identified three mineralized zones known as the Racetrack North (“RTN”), Racetrack South (“RTS”) and the Stockwork Zones. Initial drilling of these zones intersected thick intervals of significant mineralization proximal to the surface and open at depth.

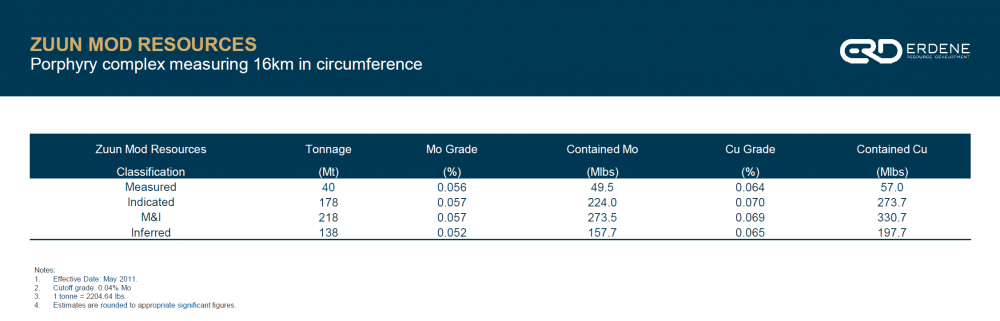

In June 2011, Erdene received an updated National Instrument 43-101 compliant resource from Minarco MineConsult of Sydney, Australia. The Zuun Mod molybdenum deposit has a Measured and Indicated Resource of 218 million metric tonnes (“Mt”) at an average grade of 0.057% molybdenum (“Mo”) and 0.069% copper (“Cu”), at a 0.04% Mo cutoff grade, which equates to 273.5 million pounds of contained Mo metal and 330.7 million pounds of contained Cu metal. In addition, Zuun Mod has an Inferred Resource of 168 Mt averaging 0.052% molybdenum and 0.065% copper. Zuun Mod is one of the largest undeveloped molybdenum-copper deposits in the Asia region and is comparable in grade and scale to other porphyry molybdenum projects currently in production or under development worldwide.

Molybdenum prices have been rising steadily since the trough of 2016 reaching all-time highs in early 2023; currently sits at ~US$20/lb. Used primarily in stainless steel and other industrial applications, molybdenum was included in the Canadian and Australian Critical Minerals Lists as well as that of the World Bank and International Energy Agency. Strong demand expected from renewables and clean energy systems.

Although demand has been largely stable, production cuts, delays in commissioning, and depletion have resulted in major shortages. An additional 50Mlbs of deficit is expected in the moly market over the next three years. China alone – the biggest consumer of the metal - experienced a shortfall of 20Mlbs in 2022.

This project was acquired from Gallant Minerals Limited in 2005 and is subject to a net smelter returns royalty of 1.5%, subject to a buy-down provision.

Peter Dalton, P.Geo. (Nova Scotia), Senior Geologist, Erdene Resource Development Corporation, is a Qualified Person within the meaning of National Instrument 43-101 and has reviewed and approved the scientific and technical information contained herein.

-

Reports

Jun 30, 2011

-

Illustrations

-

Maps/Sections